It's for US folks but I guess some concepts applies to us as well.

To save everyone the time reading, I'll do a summary of the relevant points to us. (For the rest who have good ideas to point out, feel free to comment too!)

The guide is broken into 4 parts:

- Retirement landscape

- Saving

- Spending

- Investing

On Retirement Landscape

Retirement is different now than it was in past generations. These days, individuals have varying expectations for how they wish to spend their retirement years. Many planning factors are interconnected, which require careful consideration when developing a retirement strategy.

The common misconceptions listed:

“I’ll continue to work during retirement.”

• A number of factors can cause people to retire earlier than expected, including health problems, employer issues and family obligations. (I'll quote JP Morgan here)

“I need to claim my Social Security benefits as soon as I can.”

• For Singaporeans, it refers more to our CPF, which is an annuity, it would be great if it's not the sole amount you're living on. Delaying it accumulates more interest. People are living longer nowadays. It is best if it can be supplemented by stuff like the SRS or my aim, dividend stocks. Taking out a large sum to live on is part if you do not have fiscal discipline either.

“My spending patterns won’t change much when I retire.”

• Well, as you age, you tend to get sick more often etc. Do realise that healthcare costs increases faster than inflation (most of the time). There are people out there who say that when they are old they probably spend less, but from what I have seen, they either spend as much and usually even more.

|

| Retirement Equation |

|

| Life Expectancy Probabilities (note this one based on US population, but Singapore won't be that much far off). |

The guide also pointed out the major reasons why people work in retirement

- Needs

- Buy extras

- Make ends meet

- Keep insurance or benefits

- Decreased value of savings or investments

- Wants

- To stay active and involved

- Enjoy working

- Job opportunity

- Try new career

The reasons cited for retiring earlier than planned were:

- Health problems or disability (main reason shown in the guide)

- Other work-related reason

- Care for spouse or family member

- Outdated skills

- Able to afford early retirement

- Want to do something else

The above is the chart of spending for the older Americans but the way I see it, it is more or less similar.

The tax portion isn't reflective of ours, so I'll skip it.

--------------------------------------------------

On Savings

The single most important decision individuals can make about retirement is to take responsibility for funding it themselves. Living expenses, health care costs, Social Security, pensions and future employment are all uncertain. But saving today is one way to prepare for a more stable tomorrow.

The common misconceptions listed:

“I’ve already started saving a little — I should be okay.”

• In 2014, only 44% of workers (and/or spouses) had tried to calculate how much money they would actually need to save for a comfortable retirement. — Even though that is a US statistics number, I see a similar or even higher group of people over here in Singapore in this way too. (And those who act on it is even lesser).

“Retirement is so far away — I have plenty of time to think about it.”

• The sooner you begin, the more time you have to maximize the power of compounding.

• Start saving early and regularly. Early withdrawals, loans and missed contributions can result in lower savings, less compounding and fewer assets at retirement. (JP Morgan couldn't have said it better)

• This is another issue I have noticed in Singapore as well.

Then came two really useful charts:

|

| Retirement savings checkpoints |

|

| Benefits of saving early |

Bottom line: The earlier you start, the much better of you are later. Use the magic of compounding interest to your advantage!

|

| Personal Savings Rate |

They showed a chart on the personal savings rate of Americans, which reminds me of the low savings rate of Singaporeans as well (excluding CPF), due to many factors such as overinflated lifestyles and overspending credit, which is alarming on their retirement readiness.

|

| Toxic effect on loans and withdrawals |

They also showed that by deferring and/or reducing tax, helps with greater long term growth.

We can reduce tax (and save money to invest more) by ways such as contributing to SRS and CPF. Income from stuff like SGS bonds and dividends are not taxable, so it's good looking into them =)

--------------------------------------------------

On Spending

Determining income needs during retirement is a complex equation. During working years, the goal was to save and accumulate as much as possible for the future. Now the challenge becomes managing a portfolio by withdrawing some money for today’s expenses and investing the rest for tomorrow.

The common misconceptions listed (I'll quote JP Morgan for all):

“I’ve already hit my savings target. I should be fine in retirement with the lower cost of living.”

• Spending may not decrease at all in the first few years of retirement. Some expenses tend to decline with age — while others remain steady or increase. To add on, another question would be, is the savings bare minimum for requirement or comfortable?

“As long as I withdraw a steady amount, I will be okay.”

• Withdrawing assets in volatile markets early in retirement can ravage a portfolio. Adjust your

plan and strategy regularly. (Review it annually)

• There is potential danger in investing too conservatively or withdrawing too aggressively. Either may increase the risk of tapping into principal and running out of money.

They gave a couple of charts that show a good gauge of how the rate of return would be affected while withdrawing money, household spending patterns for the different age groups in retirement, sustainability of withdrawals and rising healthcare costs in retirement. (there's other charts on their medicare, long term care as well as nursing care, but I'm not too sure how applicable).

|

| Dollar cost ravaging — timing risk of withdrawals |

|

| Changes in spending |

| |||||||||||||||

| Effects of traditional withdrawal rates on a balanced portfolio |

| |

| Rising annual health care costs in retirement |

--------------------------------------------------

On Investing

Invest for long-term growth potential and consider investing in a broader mix of assets. Financial risks don’t end when careers do. Individuals planning for a long, rewarding retirement must anticipate and overcome the obstacles that are likely to arise along the way.

The common misconceptions listed (I'll just quote JP Morgan on all again....):

“The market is too volatile. I’m going to sit on the sidelines for a bit so I don’t lose money.”

• Don’t wait to invest in volatile times. It can cause you to miss out on potential market rallies.

• Set specific retirement goals upfront — and keep focused on the long term during periods of volatility and uncertainty.

“I should invest conservatively so I don’t run the risk of losing my retirement assets.”

• Retirement-age investors have potentially long time horizons, due to rising life expectancies. By maintaining an exposure to equities in retirement, you may better keep pace with rising prices, protecting your standard of living throughout retirement.

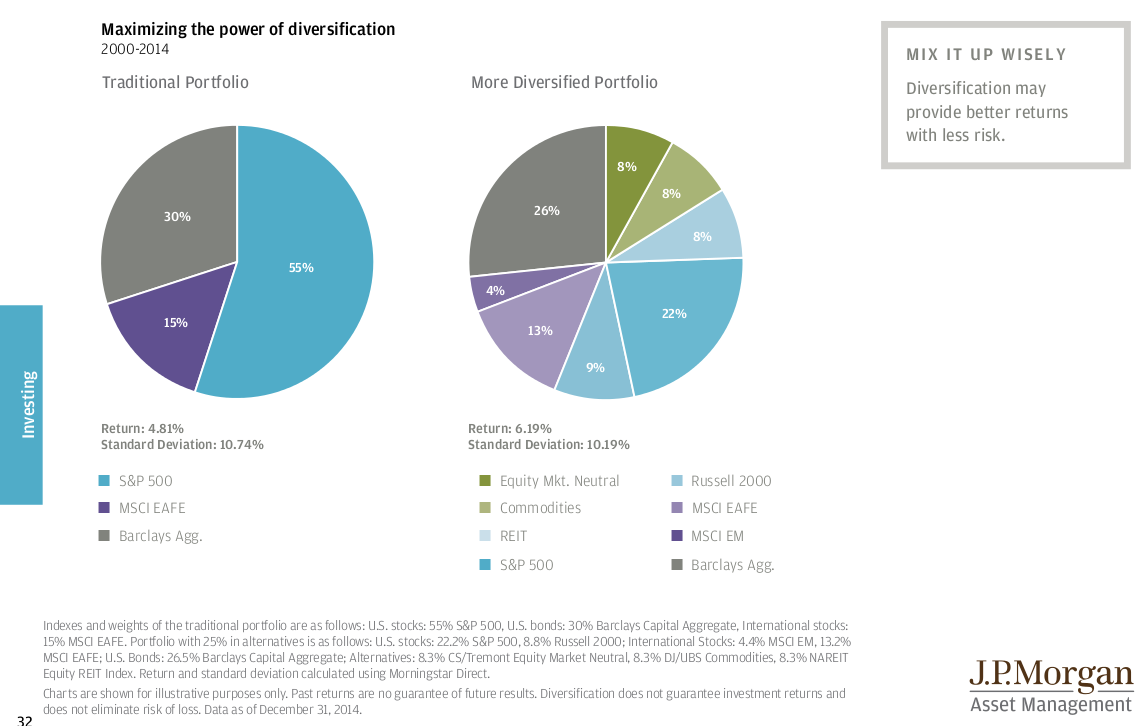

• A well-diversified portfolio may provide a smoother ride over the long term.

After that they gave quite some ideas on portfolio choices in charts below =)

|

| Structuring a portfolio to match investor goals |

|

| Structuring a portfolio: the bucket strategy |

|

| Diversification |

|

| Impact of being out of the market |

|

| Major asset classes vs. inflation |

Personal note: A good point put across, for those risk adverse folks out there, staying in cash isn't exactly a very good solution. It might be even worse.

|

| Maintain a diversified approach and rebalance |

Personal note: Diversification of equities to achieve a stable return. Looking to balance every year. But do note that over-diversification screws up too.

Charts after these are US tax charts, retiring/changing jobs and medicare which are not applicable over here. These are better served by info from Singapore's IRAS, CPF, etc.

|

| Annuity basics |

Lastly, this is some basics of annuities, which our CPF is one. =) Gives some ideas how they work and the other types of annuities (that can be purchased from many firms out there).

Well, that's the end of the whole guide. Hope it helps, I'm pretty beat after compiling. x_x

No comments:

Post a Comment